Knowledge Center

Your all-in-one hub for everything AudaCity Capital. Explore clear guides, program breakdowns, trading rules, and step-by-step instructions, designed to help you trade confidently and get the most out of your funded journey.

Trading Guidelines

Yes, scalping is permitted. However, each individual trade must remain open for a minimum of two (2) minutes. Trade(s) closed in less than two minutes, or trading activity that appears suspicious or resembles arbitrage (which is prohibited), may result in action by our Risk Team.

All trades are closely monitored by the Risk Team.

Following our migration update on May 30, 2025, all assets are now available in standard lot sizes.

While there are no overall lot size restrictions on the account, our provider has implemented a maximum limit of 10 lots per open position as part of risk management measures.

You may open multiple positions, but each individual position cannot exceed 10 lots.

Our funded trader account and ability challenge account does not have a lot size limitation nor stoploss requirements. However, we ask our traders to manage their own risk.

No, both the Challenge and Funded Trading stages come with an unlimited trading period.

This structure is designed to reduce pressure and allow traders to perform at their best without the stress of deadlines. You’re free to trade at your own pace while meeting the program’s risk management requirements.

Copy trading is allowed between your own accounts within Audacity Capital, copying from an external account is allowed only if the account belongs to you. Third-party copying is not permitted.

You may hold trades over the weekend and trade during news events. Simply avoid opening or adding to positions within 3 minutes before or after any high impact news release or speech, as that can be identified as excessive risk. this applies to all programs (Ability Challenge, Ability One, FTP(instant funding):

Which events are classified as major news?

Major news events typically include Non-Farm Payrolls (NFP), Federal Open Market Committee (FOMC) meetings, interest rate decisions, and speeches by central bank officials. These events have significant impacts on financial markets \nand are closely monitored by traders for potential trading opportunities and market volatility.

Do you have any recommendations for a news calendar?

We highly recommend utilizing Forex Factory (https://www.forexfactory.com/) for comprehensive coverage of market news and economic events. This platform serves as an invaluable resource for traders, offering detailed insights into key developments that can impact financial markets.

Yes! Run Ability Challenge, Ability One, and FTP(instant funding) simultaneously for seamless experience.

Max allocation:

- Ability Challenge (2-Step): $240K max

- Ability One (1-Step): $240K max

- FTP (Instant Funding): $240K max

Example: a trader could have two 120K Ability Challenge accounts and four 60K Funded Live accounts. Please note that accounts from different programs cannot be combined to reach a total of 480K under any single program.

EAs are allowed if they follow our prohibited-strategy rules and are not sourced from third-party signals. Copy trading is allowed between your own accounts within Audacity Capital, copying from an external account is allowed only if the account belongs to you. Third-party copying is not permitted.

No consistency rule required

There is no consistency rule in place. As long as you manage your risk properly and adhere to our risk management guidelines, you can trade according to your strategy without restrictions on profit distribution across trading days.

Focus on risk management

Our priority is sustainable trading through proper risk control. The risk team evaluates accounts based on overall performance and compliance with drawdown limits, not daily consistency metrics.

Ability Challenge (2-Step)

- Phase 1 & 2: Minimum 4 trading days each (no time limit to hit targets).

- Funded Account: 0 minimum trading days.

Ability One (1-Step)

- Phase 1: Minimum 3 trading days (no time limit to hit target).

- Funded Account: 0 minimum trading days.

FTP (Instant Funding)

Minimum 5 trading days (at least 3 profitable).

At AudaCity Capital, our Ability Challenge and Verification stages use a Static Drawdown system.

Static drawdown is straightforward and protects traders from unexpected changes during the trading day.

How Static Drawdown Works

- Your daily drawdown limit resets every day at rollover (00:00 GMT+2) based on the higher value between your balance or equity at that moment.

- Once the limit is set at rollover, it does not move during the day, even if your equity increases due to open profits.

- You are free to hold trades overnight — the new daily level will update automatically at the next day’s rollover.

- If your equity falls below the allowed limit at any time during the day, the account will be paused or breached (depending on the stage).

Ability Challenge Drawdown Rules

- Daily Drawdown: 7.5%

- Maximum Drawdown: 15%

Example – 120K Ability Account

At rollover (00:00 GMT+2):

Balance/Equity = $120,000

- Daily Drawdown (7.5%) → $9,000

→ Minimum equity allowed for the day: $111,000 - Maximum Drawdown (15%) → $18,000

→ Account breach level: $102,000

During the day:

Even if equity rises to $130,000 during the trading day, the daily limit stays at $111,000 until the next rollover.

Verification Stage Drawdown Rules

- Daily Drawdown: 5%

- Maximum Drawdown: 10%

Example

60K Verification AccountAt rollover (00:00 GMT+2):

Balance/Equity = $60,000

- Daily Drawdown (5%) → $3,000

→ Minimum equity allowed for the day: $57,000 - Maximum Drawdown (10%) → $6,000

→ Account breach level: $54,000

During the day:

If equity increases to $62,500 intraday, the daily limit still remains $57,000 until the next rollover.

Key Points for Traders

- Your daily drawdown resets every day at rollover, giving you a fresh start.

- The drawdown level is always based on balance/equity at rollover, whichever is higher.

- Intraday gains do not raise the drawdown limit.

- Static drawdown provides simplicity, predictability and transparency.

Ability ONE 120K Account

Absolute Drawdown (Static): 6%

This is the maximum loss allowed from the initial account balance.

Daily Drawdown (Static): 3%

This is the maximum loss permitted within a single trading day, based on the starting balance or equity of that day (whichever is higher).

Example

At rollover:

Highest value = $120,000

Daily DD (3%) = 3,600

Absolute DD (6%) = 7,200

So the limits are:

- Daily DD limit: 120,000 – 3,600 = 116,400

- Absolute DD limit: 120,000 – 7,200 = 112,800

FTP (Funded Trader Program)

Trailing Drawdown

Unlike the Ability programs, the FTP uses a trailing drawdown.

This means:

- The maximum equity the account reaches at any time becomes the new reference point.

- The drawdown limit moves upward as the account grows.

- It never goes back down.

FTP Daily DD: 5% (Trailing)

Example

7.5K FTP Account (5% Trailing DD)

If your equity reaches:

$7,800 highest point of the day

Your DD limit becomes:

7,800 × 95% = 7,410

If at any time your equity goes below 7,410, the account is breached.

This applies throughout the day, not just at rollover.

Ability ONE Challenge (Static Drawdown)

Ability ONE also uses static drawdown, resetting every day at rollover (GMT+2).

The structure is the same as Ability Challenge but with different percentages depending on the level.

Daily DD: 3%

Absolute DD: 6%

You are allowed to hold positions over the weekend throughout both challenge phases as well as on the funded account stage of the Ability Challenge, Ability One, and FTP(instant funding).

You can hold positions overnight in all stages of the Ability Challenge, Ability One, and FTP(instant funding).

- High-Frequency Trading (HFT)

Using EAs to rapidly open and close trades within seconds is strictly prohibited. These systems exploit micro price movements and take advantage of them.

Using High-Frequency Trading (HFT) bots, Expert Advisors (EA), and HFT algorithms is not allowed on our platforms under any circumstances.

HFT involves using advanced computer programs and high-speed networks to make lots of trades very quickly, often in fractions of a second. We prohibit HFT because it can lead to market manipulation, give unfair advantages, and cause market instability. If any trader is found using HFT, they will violate our Terms of Use and will be banned from trading on our platform. For examples of HFT abuse, please refer to the sections on Trading on Delayed Data Feed and Trading on Delayed Trading Chart below.

HFT includes complex trading strategies that execute many orders in a very short time. One prohibited HFT strategy is Latency Arbitrage, which exploits the time delay between when a trade is made and when market data is received.

- Tick Scalping

Opening and closing positions within a very short time (such as 2 minutes or less, typically a few seconds to a couple of minutes) based on minimal price fluctuations is not permitted. This includes strategies that rely solely on small price moves rather than genuine market direction or analysis.

- Hedging or Group Hedging Across Multiple Accounts

Simultaneously placing both buy and sell positions in the same account or across different accounts to minimize risk or form arbitrage is not allowed.

Hedging or group hedging across multiple accounts, on the other hand, refers to a trading strategy where an individual or group of individuals open multiple accounts with the same firm or different firms and place trades in opposite directions (i.e., buy/sell), on the same asset, across all accounts.

This can be done in an attempt to profit from the price movements of an asset without having to take on significant market risk.

This type of trading behavior is also known as "Arbitrage" and "Grid Trading" and is not permitted at Audacity Capital.

However, while trading with a Firm, you would be losing the firm money on one account and generating a profit on the other, resulting in risk-free profits, which are violations of compliance with the functioning of the real financial market.

- Averaging Down / Martingale Strategies

Opening more positions when a trade moves against your initial bias, regardless of lot size, is considered high-risk and is strictly prohibited.

The Martingale trading strategy is a way of trading where you increase the lot size that you trade after each loss, hoping that a win will recover all the previous losses and make a profit. This method is like gambling and is very risky because it can lead to big losses and losing all your money if you have a long losing streak.

In theory, this strategy always works, but in real life, it only works if you have unlimited money. Companies set a limit on how much you can lose, and traders should plan their strategy based on this limit.

It's important to have a clear plan to manage risks and not risk your entire account on one trade. Therefore, this kind of trading is not allowed at Audacity Capital.

- Dollar Cost Averaging

Dollar Cost Averaging(DCA) is a way of trading where you keep on opening a position of the same lot size or a different size every time the trade starts going against your bias, hoping that the price will reverse eventually and you will end up making a profit.

This strategy is effective while investing in an asset for long term, however, while trading with prop firms it is risky and could let to drawdown violations if the price fails to reverse.

We require our traders to have a proper trading plan and solid risk management while trading with us rather than simply adding more positions to a losing trade, hence this trading style is prohibited.

- Use of Third-Party Expert Advisors (EAs)

Only personally developed EAs (Expert Advisors) are allowed. Using commercially available or third-party EAs created by someone else is strictly not permitted.

- Account Management by Third Parties

Allowing another person or service to trade on your behalf, whether paid or unpaid, is not allowed under any circumstances.

- Copy Trading

Mirroring or duplicating trades from another trader’s account, whether manually or via automated tools, is not permitted.

- Grid Trading

Placing a series of buy and/or sell orders at predefined intervals to create a price grid is considered a form of arbitrage and is not allowed.

- One-Sided Bets During News Events

Placing pending orders (limit or stop) shortly before high-impact news events with the intent to capitalize on volatility is not allowed.

- Exploitation of System Vulnerabilities

Deliberately or inadvertently using trading strategies that exploit flaws in the system, such as pricing discrepancies or latency in data updates, is not permitted

- Uncritical Directional Trading

The practice of systematically initiating trades in a single direction without rigorous market assessment or strategic justification, reflecting a mechanical and unconsidered trading process, is not permitted.

- Automated Multi-Trade Activity

A trading approach characterized by opening multiple positions simultaneously, typically facilitated by automatic trading tools, indicates that the trader is not directly overseeing or actively managing the strategy is not permitted.

- Lot size abuse

Opening trades with unrealistic risk relative to account size, especially at market open/close or during news, is prohibited.

Note: The Risk team reviews the account when you pass the challenge or request a payout and if any nefarious activities are found then AudaCity Capital has the right to ask the traders to change their trading strategy or even breach the account in some cases.

Ability Challenge (2-Step)

Unlimited trading days to complete both phases.

Ability One (1-Step)

Unlimited trading days to hit your profit target.

FTP (Instant Funding)

Unlimited trading days to reach 10% profit target.

No time pressure, focus on consistent performance.

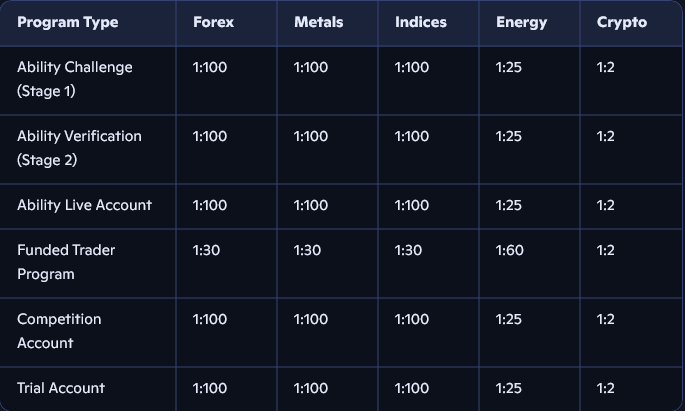

Please be advised of the latest updates to our leverage settings across all offered programs and asset classes. Kindly refer to the table below for the specific leverage ratios applicable to each account type:

We encourage all traders to review these updates and adjust their strategies accordingly. Should you have any questions or require further clarification, feel free to reach out to our support team.

As part of our standard policy, the use of VPN services by traders is generally prohibited due to concerns related to IP tracking and the risk of server misuse. However, in special cases where a trader presents a valid justification, we may consider allowing VPN usage. In such instances, the trader will be required to submit detailed information outlining the purpose of the VPN. These requests will be carefully reviewed and are subject to approval.

Conversely, the use of a VPS is permitted, provided it is utilized for Expert Advisors (EAs) in a manner that does not result in server abuse.

You are allowed to trade using other WiFi networks. However, please be aware that our risk team is closely monitoring traders' accounts. If we detect any server abuse through the use of arbitrage, HFT, DCA, or other prohibited strategies, we will immediately and permanently deactivate the account. Thank you for your understanding.