How to Trade Gold (XAUUSD): The Complete Guide

Key Takeaways

- Gold (XAUUSD) is volatile and highly liquid.

- Risk management matters more than entry precision.

- Undercapitalization is one of the main causes of failure.

- Funded trading provides a pathway to scale responsibly.

- Professional structure separates traders from gamblers.

Gold remains one of the most traded instruments in global financial markets. Whether you're searching for how to trade gold, how to trade gold in forex, or how to trade XAUUSD, this complete guide explains how professional traders approach the market.

Gold offers high volatility, strong liquidity, and clear technical reactions. But without discipline and proper capital, it can quickly wipe out unprepared traders.

Let’s break it down step by step.

What Does It Mean to Trade Gold?

When people ask how to trade in gold, they usually mean speculating on price movements rather than buying physical gold bars.

You can trade gold through:

- Forex (XAUUSD)

- Gold futures contracts

- Gold ETFs or mining stocks

Each method has different capital requirements and risk exposure.

How to Trade Gold in Forex (XAUUSD) ?

The most popular way to trade gold is through the forex market using XAUUSD.

If you're researching:

- how to trade gold in forex

- how to trade on XAUUSD

how to trade gold XAUUSD

Here’s how professionals do it:

Step 1: Choose a Trading Platform

Most traders use MetaTrader platforms.

Step 2: Analyze Higher Timeframes

Start with 4H or Daily charts to identify bias.

Step 3: Refine Entries

Use 5M–15M charts for precision entries.

Step 4: Apply Risk Management

Risk 0.5%–1% per trade.

Gold can move 100–300+ pips per session. Precision and discipline are essential.

How to Trade Gold on MetaTrader 5 ?

If you're asking how to trade gold on MetaTrader 5, the process is simple:

- Open MT5

- Add XAUUSD to Market Watch

- Open the chart

- Apply your strategy

- Set stop loss and take profit

Platform knowledge is basic — strategy and discipline are advanced.

How to Day Trade Gold ?

If you're learning how to day trade gold, focus on:

- London session

- New York session

- Major US economic news

Professional gold traders:

- Wait for structure

- Avoid emotional entries

- Respect volatility

Gold punishes impulsive trading.

How to Trade Gold in the Stock Market ?

Searching for how to trade gold in the stock market usually refers to:

- Gold ETFs

- Mining stocks

These move slower than XAUUSD and may suit longer-term investors.

How Much Money Do You Need to Trade Gold?

Common searches include:

- how much do you need to trade gold

- how much money do you need to trade gold

- how much do you need to trade XAUUSD

Technically, you can start with a few hundred dollars.

Realistically?

Professional traders recommend:

- $1,000–$2,000 minimum

- Risking no more than 1% per trade

The biggest problem traders face isn’t strategy, it’s undercapitalization.

Small accounts often lead to over-leverage.

How to Become a Gold Trader ?

If you're serious about how to become a gold trader, focus on the following:

- Market structure

- Macro understanding

- Strict risk management

- Psychological discipline

Consistency matters more than big wins.

Scaling Your Gold Trading with Funded Capital

Many traders understand how to trade gold online but struggle to scale due to limited capital.

Instead of risking large personal funds, traders can access funded accounts through proprietary trading firms like Audacity Capital.

Audacity Capital provides traders access to larger capital allocations once they demonstrate discipline and consistency.

This allows traders to:

- Trade gold (XAUUSD) with more capital

- Apply professional risk management

- Scale profits without excessive personal financial risk

For disciplined traders, funded capital transforms gold volatility into structured opportunity.

Final Thoughts

Learning how to trade gold isn’t just about strategy. it’s about structure, capital, and discipline.

Gold can generate significant opportunity.

But without proper funding and risk control, volatility becomes dangerous.

For traders who have built consistency and want to scale professionally, Audacity Capital offers a structured pathway to trade gold with larger capital allocations.

Trade with discipline.

Trade with structure.

Trade like a professional.

FAQ

Beginners typically start by learning how to trade gold in forex through XAUUSD using a regulated broker and proper risk management.

You trade the XAUUSD pair. Buying means you expect gold to rise; selling means you expect it to fall.

Use regulated brokers, apply strict risk management, and avoid excessive leverage.

Pronto ad applicare un rischio disciplinato alle criptovalute? Esplora i nuovi strumenti crypto di Audacity Capital e porta la tua strategia di trading.

Scopri di PiùNewsletter

Iscriviti alla newsletter per restare aggiornato.

Unisciti Alla Nostra Community Social

Inizia Il Tuo Viaggio Oggi Con La Nostra Prova Gratuita

Mostra con orgoglio le tue abilità e i tuoi risultati attraverso certificati e ottieni riconoscimenti per il tuo duro lavoro e dedizione da potenziali investitori e colleghi.

Prova GratuitaArticoli Correlati

From Strategy To Structure: How Professional Traders Turn Market Knowledge Into Consistent Profitability

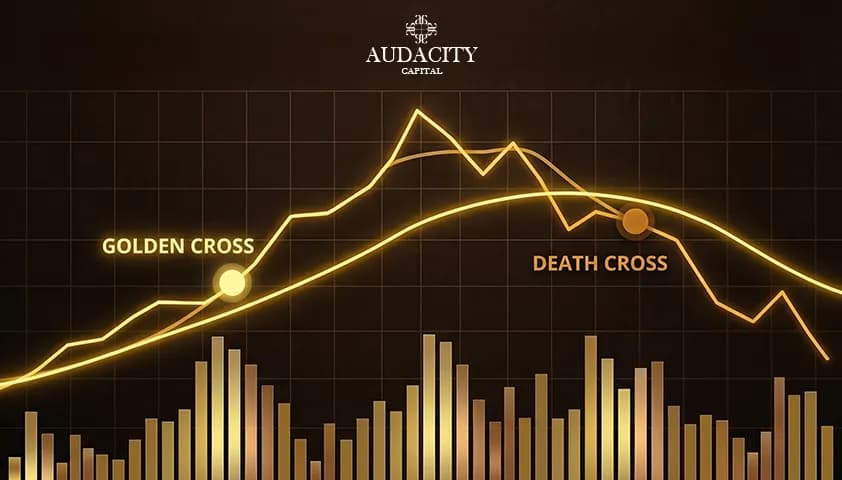

The Golden Cross And Death Cross A Simple Yet Powerful Forex Strategy Explained

The Human + Machine Equation: Why The Best Traders Think Like Algorithms (And Feel Like Humans)